1. DEPOSIT, PREMIUM PAYMENTS AND FINANCIAL REQUIREMENTS

A. Deposit: At the inception of a new Member’s coverage, that Member shall pay a deposit to TBG in an amount equal to 20% of the Member’s annualized premium for workers’ compensation liability coverage. The deposit shall be adjusted periodically by TBG to maintain the deposit at approximately 20% of the annual premium level during the entire period of membership. The deposit shall not be interest-bearing.

The other options are prepaying 25% of the annualized premium of each agreement year which will be applied to the final three months of the agreement, or provide an irrevocable letter of credit.

B. Premium: The premium shall be reported and paid monthly based on actual payroll from the preceding month and is due on the 15th day of each month of the agreement year. If there is no payroll to report in a given month, the Member must still submit a monthly report indicating zero payroll in order to avoid a late fee.

A Member (the “Guarantor”) who is a parent, subsidiary or affiliate of another Member serves as a guarantor of such other Member’s obligations to make any payment due TBG hereunder on a joint and several basis with the parent, subsidiary or affiliate. Any such parent, subsidiary or affiliate’s failure to comply with any term or condition of this Plan of Operation shall be considered a breach thereof by the Guarantor.

• Experience Modification Factor: In determining the annual modified premium of each Member, TBG shall calculate an experience modification factor according to the methods and rules used by the Minnesota Workers’ Compensation Insurance Association (MWCIA).

• Audit: Following the expiration of each agreement period, we will conduct an audit, which is a review of your records and operations to ensure that the coverage and reported payroll information is correct. The audit may result in an additional or return premium.

• Minimum Premium: All coverage is subject to an initial policy written minimum premium of $5,000 effective 7-1-2012.

C. Additional Requirements: Minnesota Statutes for commercial self-insurance groups require TBG to file a financial compilation report with the Minnesota Department of Commerce. To prepare this report and file it timely, we will request that you forward a copy of your most recent financial statements (compiled, reviewed or audited financial statements, including the signed CPA letter, or most recent federal income tax returns with schedules filed by your company). If, in any Fund Year, any TBG Member comprises over 25 percent of the total premiums paid by all TBG Members, that Member’s financial statement must be reviewed or independently audited. The statement must be submitted to the Commissioner of the Minnesota Department of Commerce by May 1st of the following year.

D. Non-Renewal of Coverage: If a Member does not renew its workers’ compensation liability coverage with TBG or if the coverage is canceled or terminated by either TBG or the Member, an audit shall be performed and the final annualized premium for the Member shall be determined. After an audit, any overpayment of premium shall be refunded to the Member. Any balance owed by the Member to TBG shall be first deducted from the deposit with any remaining balance of the deposit refunded to the Member. If there remains a balance owed to TBG, the Member shall make full payment to TBG within 30 days of receiving notice of the deficiency.

2. TBG DIVIDEND DISTRIBUTION POLICY

Original Date: 12-01-2007

Last Change: 04-04-2019

Last Review: 02-14-2019

A. Dividend Distribution Policy Background: The objective of this policy is to develop a method based on solid insurance principles, is fiscally responsible, and returns the dividends to the Members on a basis that minimizes the chance of an assessment. It is intended that all surplus funds be returned to the Members. The surplus funds that arise during a Fund Year should be recorded on the income statement with the unpaid portion of these amounts added to the liabilities on the balance sheet. The Board believes that these are binding, enforceable, and unconditional obligations to return the monies to the policyholders. The applicable dividend policy is the policy in place when a dividend is paid, not the dividend policy which was in place during the Fund Year from which the dividend is being calculated and paid.

B. General: Dividend distributions are paid from Member Distribution Payable (MDP) which consists of investment income and excess underwriting income. The policy was developed based on the following considerations:

• The WC Claim Tail – Dividend distributions will be paid on a basis that coincides with the timeframe the majority of the WC claims are paid. Once an initial distribution of a Fund year has been dispersed the balance of the distribution payout will occur per the payout schedule and TBG Board approval.

• Timing of Dividend Distribution Payment – Dividend distribution payments will be made at the TBG Board’s discretion and may be made at any time during a Fund Year.

C. Eligibility: A TBG Member is eligible to receive a dividend distribution if they were a TBG Member during the Fund year designated by TBG’s Board of Directors for dividend distribution and are still a Member of TBG on the date(s) when the authorized dividend distribution is paid or credited to the Eligible Member.

D. Dividend Distribution and Eligibility Determination: The TBG Board of Directors will determine if a dividend distribution is warranted, the amount of the dividend distribution if any, and the Fund Years’ that are eligible at the first Board meeting conducted after July first of each Fund Year.

E. Dividend Distribution Approval: Any dividend distribution from Member Distribution Payable must be approved by the TBG Board of Directors and the Minnesota Department of Commerce.

F. Member Distribution Payable: The goal is to maintain MDP in an amount that reduces the possibility of an assessment to the Members and complies with MN Statute 79A.22 Subd.11.

G. Dividend Distribution Payment: If a dividend distribution is authorized, the payment to the Eligible Members will be made on a date determined by the TBG Board of Directors. The dividend distribution payment(s) are based on the following criteria:

• The amount of profit an individual Member has contributed to the Fund in a Fund Year.

• The Expense Ratio of each Fund Year will be calculated to determine the breakeven loss ratio of that Fund Year. The Expense Ratio is the result of totaling all of the expenses for that Fund Year (except reinsurance) and dividing that number by the net premium (audited premium less reinsurance expense). The Expense Ratio is subtracted from 1.00 and the result is the breakeven loss ratio.

• The profit for a Fund Year(s) is the total MDP for that Fund Year(s).

• Once the breakeven loss ratio and profit amount are known the individual Member distribution is calculated based on the Member’s loss ratio in comparison to the breakeven loss ratio of the Fund. Members with a loss ratio greater than the breakeven loss ratio will not be eligible for a distribution. Members with a loss ratio less than the breakeven loss ratio will be eligible to receive a dividend in proportion to the amount of their contribution to profit.

• After an initial dividend has been paid out for a Fund year, the results are recalculated annually to take into account any future change in the claim development of that Fund Year, either positive or negative. The annual recalculation protects the Fund against any adverse claim development that may occur.

Dividend Payment Schedule

Once a dividend distribution has been authorized, the TBG Board of Directors will determine the amount of the annual dividend paid subject to the following maximum percentage payout each year.

• 1st Year – 20% of the total authorized dividend

• 2nd Year – 40% of the total authorized dividend less amounts preciously paid

• 3rd Year – 60% of the total authorized dividend less amounts previously paid

• 4th Year – 80% of the total authorized dividend less amounts previously paid

• 5th Year – At discretion of TBG Board of Directors after a Fund Year has been closed with no future claim liabilities

3. FUND DEFICIT

A. Assessment of Deficit: When, in accordance with applicable laws and regulations of the State of Minnesota, a deficit for any Fund Year exists, the TBG Board of Directors may make up such deficit as follows:

• The Board may order an assessment of every Member from the deficit Fund Year, whether or not the Member continues to be a Member at the time of the assessment. Such assessment will be pro-rata in the ratio of the Audited Premium of each Member bears to the total Audited Premium of all the Members during the deficit Fund Year. Additional assessments may be made as necessary.

4. PENALTIES: In the event that any additional compensation pursuant to M.S. Chap. 176.225, or similar statute, or damages pursuant to M.S. Chap. 176.82, or similar statute, or any similar damages are assessed against TBG, the Board, after authorizing payment of such penalty or damages, shall pursue recovery in full from the Members, former Members, person and/or persons whose actions gave rise to the assessment of such penalty or judgment.

5. DISCIPLINE OF MEMBERS

A. Expulsion of Members: The Board may expel Members from TBG for the following reasons:

• Non-payment of Premium or Assessments: In the event that the monthly payroll report and premium payment due to the program by a Member are not paid by the 15th of the month, a late fee penalty of $100 will be charged after five (5) days of delinquency. A written notice of termination shall be sent via U.S.Mail to said Member after ten (10) days of delinquency. If after thirty (30) days from the date of notice, all past due amounts are not paid, its membership in TBG shall terminate, effective at twelve o’clock midnight on the thirtieth day from the date notice of the termination was given. Additional liability may exist after the termination date which would be determined by an audit. Any payments received from a former Member after the termination of workers’ compensation coverage shall not result in an automatic reinstatement or continuation of workers’ compensation coverage. The payment will be applied to any outstanding liability owed by the former Member to TBG and any additional liability that may exist as may be determined by audit. The balance of the payments will then be returned to the former Member.

At the discretion of TBG, a Member may be reinstated if all premium has been paid to date, if the member has no past due obligations owed to TBG, if the Member has had no known losses since the time coverage was cancelled, and if the Member pays a $100 reinstatement fee and complies with any other TBG requirements for reinstatement.

• Adverse Loss Experience: If in any two year period of TBG, a Member incurs losses in excess of his/her premium for that two year period; a detailed analysis of that Member’s losses shall be undertaken by the TBG underwriting staff. After reviewing this analysis, TBG underwriting may terminate the Member’s membership in TBG upon thirty (30) days written notice.

• Noncompliance with Safety Recommendations: If in the opinion of the TBG Staff, any Member has failed to comply with the safety and loss control recommendations provided by TBG Loss Control, its membership in TBG may be terminated upon thirty (30) days written notice.

• Failure to Submit Financials: Failure to submit the latest financial statement by August 15th of each year when asked. The information is necessary in order to complete a required Department of Commerce report. Non-compliance with this requirement may result in expulsion from the Fund.

• Other Reasons: Membership in this Group may be terminated upon thirty (30) days written notice for any of the following reasons:

i. Failure to report losses promptly.

ii. Failure to cooperate in an investigation and/or defense of claims.

iii Failure to maintain, on a continuing basis, the membership qualifications outlined in Article IV Paragraph 1 of TBG’s bylaws.

iv. Misrepresentation or fraud made by or with the knowledge of the Member in obtaining or continuing membership.

v. Substantial change in the risk assumed.

vi. Refusal of the Member to eliminate known conditions that increase

the potential for loss after notification by TBG Loss Control, that

the condition must be removed.

vii. Based upon a recommendation of the Commerce Commissioner.

viii. Any other regulatory basis permitted by the applicable law and rule of

the State of Minnesota.

ix. Failure to provide the TBG Audit Department, its agents or employees,

with requested information to perform the annual audit.

x. Failure to maintain, on a continuing basis, the payroll requirements that

produce the minimum premium.

6. WITHDRAWAL FROM MEMBERSHIP: Once accepted for membership, a Member must belong to TBG for at least one year. If a Member voluntarily terminates its membership in TBG during the second or third year of their annual membership, TBG shall assess the Member the following penalties: 25% of the previous year’s annual audited premium due from that Member if termination occurs within the second year of membership, and 15% of the previous year’s annual audited premium due from that Member if termination occurs within the third year.

No penalty shall be required if an employer’s withdrawal is due to merger, dissolution, sale of the company, or change in the type of business so that it is no longer engaged in the same industry as the rest of the employers of TBG. Any additional deficit determined after withdrawal to be attributable to the withdrawn Member shall be paid to TBG by the withdrawn Member upon demand by TBG.

7. MEMBER DISPUTES: Any dispute between Members regarding any matter concerning TBG shall be resolved by the determination of a simple majority from the Board.

8. MEMBER RIGHT OF SUBROGATION: Each Member shall assign to TBG its right to subrogation under Minn. Stat. § 176.061 in connection with any injury occurring during its period of membership.

9. COSTS AND FEES: If a Member owes money to TBG due to non-payment of premiums, assessments, withdrawal from membership or any other reason, and the Member fails to promptly pay those fees, the Member must reimburse TBG for any and all costs, disbursements and fees, including attorney’s fees, expended by TBG in its efforts to collect the money owed by the Member.

10. INVESTMENTS OF THE FUND: The investments of the Fund must comply with Minnesota statute 79A.22. The Investment Committee shall choose an Investment Advisor to develop an Investment Policy Statement subject to Investment Committee approval. The Investment Advisor will oversee the investments of the Fund and make recommendations to the Investment Committee. The Investment Committee will meet with the Investment Advisor(s) on a periodic basis to ensure the IPS is being followed and to make any changes as needed.

11. LOSS CONTROL SERVICES: Loss control services will be provided to the Members of the Fund on an as needed basis and be available to all Members of the Fund.

The Builders Group Commercial Self Insurance Group Amended and Restated Bylaws

This group self-insured workers’ compensation program has been created pursuant to Minnesota Statutes § 79A.19-79A.32, and is governed by Minnesota Statutes § § 79A.19 et seq.; 176.181, Subd. 2, and Minnesota Rules Revised Chapter 2780.

ARTICLE I

NAME AND EFFECTIVE DATE

1. Name. The name of this group will be:

The Builders Group, Workers’ Compensation Self Insurers Group, commonly known as The Builders Group (“TBG”).

2. Commencement Date. TBG Shall commence operations on May 12, 1997.

ARTICLE II

PURPOSE

1. Purpose. The purpose of TBG is to establish and operate a group self-insured workers’ compensation program pursuant to applicable Minnesota statutes and regulations as an unincorporated association. Said program shall be operated though:

A. The appointment of a Fiscal Agent to receive, maintain and administer the funds of TBG and other duties as may be assigned to it by the Board of Directors, hereinafter referred to as the Board.

B. The appointment of a Licensed Service Company to adjust and settle claims and assure compliance with all applicable laws and regulations of the State of Minnesota. Where permitted by law, employees and agents of TBG may perform any of the above-mentioned services or functions and such other duties which may be assigned to them by the Board.

C. The language of the TBG Plan of Operation, dated January 1, 2014 as amended, is herby incorporated into these bylaws by reference.

ARTICLE III

DEFINITIONS

1. Manual Premium – “Manual Premium” shall mean a sum no less than the total exposure base defined in the Minnesota Workers’ Compensation Insurers Association’s (MWCIA) rating manual of rules an classifications multiplied by pure premium rates issued by the MWCIA and approved for use in Minnesota by the Commissioner of Commerce. These rates are multiplied by a loss cost multiplier that is approved annually by the TBG Board of Directors.

2. Member – “Member” shall mean a member that meets the Qualifications in Article IV (1).

3. Modified Premium – “Modified Premium” Shall mean the total manual premium as defined in the Minnesota workers’ Compensation Insureres Association’s manual of rules, classifications, and rates approved for use in Minnesota, above modified by an experience rating plan approved by the commissioner of Commerce.

4. Net Deposit Premium – “Net Deposit Premium” shall mean the modified premium reduced by discounts which may be applied in accordance with the credit schedule based on the Member’s individual risk characteristics.

ARTICLE IV

MEMBERSHIP

1. Qualifications: Every Member of TBG must be in sound financial condition; and accept joint and several liability for all losses sustained by this group self insured fund. An applicant for membership shall submit a written application, consent to a safety inspection by loss control representatives, provide workers’ compensation loss history consisting of information regarding its workers’ compensation premium and losses for a period up to 5 years for review by TBG underwriters, and a reviewed or audited financial statement completed within the previous 12 months; or, if allowed by law, the Board may allow other alternatives.

2. Admission for Membership. Admission to membership shall be by majority vote of a Membership Committee established by the Board for that purpose. The Executive Committee shall be the Membership Committee unless the Board creates a separate Membership Committee. In the event of a tie vote, the Chairman shall cast an additional vote to decide the issue. Consideration of new Members shall be based upon information submitted by the underwriter(s) that meets the Qualifications in Article IV (.).

3. Commencement of Coverage. Coverage shall commence on the effective date of the Member’s agreement, provided, however, membership in TBG shall not be effective until the required deposit premium has been paid.

4. Rights of Members: No Member shall have any right, title or interest whatsoever, either legal or equitable, in the assets of TBG except at such time as a dividend distribution has been authorized by the Board in accordance with the provisions of Minnesota Statute Chapter 79A.22 Subd. 8. Each approved Member shall have the right, with other Members of TBG having a common interest, of obtaining workers’ compensation coverage through TBG, as required by Minnesota Statutes and Minnesota Rules.

5. Voting: Each Member is entitled to one vote on all matters coming before the members at all annual or special meetings of the Members.

6. Meetings: An Annual Meeting of Members shall be held on or before the final day of May of each Fund Year, for the purpose of electing Director(s), reviewing TBG;s prior years’ performance, and conducting such other business as may come before the Members. Each Member shall receive 30 calendar days written notice of the time and place of such meetings. The written notice shall be effective at the time of mailing. Other meetings of the Members may be held after 7 calendar days notice. Such notice, including an agenda of the meeting shall be given to all Members.

7. Quorum and Voting: A quorum for the conduct of business at a meeting of Members shall be 10% of the total Member of the Fund. Members may appear in person, or by a written appointment of a proxy, appointing the chairperson or Vice-chairperson to vote the proxies as directed b y the Board. A majority of those present at a meeting either in person or by proxy, is necessary to approve motions at the meeting.

ARTICLE V

GOVERNANCE

1. Powers and Duties of Board of Directors: The affairs of TBG shall be managed by or under the direction of a Board of Directors consisting of at least seven (7) members (the “Board”). The Board shall have all of the powers, authority, duties and responsibilities which are necessary for general supervision and operation of TBG and are in accordance with the Bylaws. The Board, at its sole discretion, shall:

A. Appoint or terminate the appointment of a Fiscal Agent who shall serve for such period and shall be delegated such powers and duties as may be set forth in an Agreement signed by the Board and the Fiscal Agent.

B. Appoint, or terminate the appointment of a Licensed Service Company who shall serve for such period and shall be delegated such powers and duties as may be set forth in an agreement and signed by the Board and the Licensed Service Company.

C. The Board shall have authority to hire employees and agents of TBG. The Board may delegate to the Fiscal Agent, Licensed Service Company and TBG employees the day to day management of TBG, Directors shall not be liable for the willful and malicious acts of the Fiscal Agent, the Licensed Service Company, TBG employees or other TBG agents unless and to the extent that such Director shall have actual prior knowledge of such willful and malicious acts.

D. The Board shall have the power to elect the following standing committees: Nominating Committee, Membership Committee, Investment Committee, Bylaws Committee and such other committees may be reviewed by the Board and can be vacated by majority vote of the board.

E. The Board shall carry out those duties imposed upon them by TBG’s bylaws, except to the extent that such duties are delegated to the Fiscal Agent, the Licensed Service Company, and employees, committees and agents of TBG as set forth above.

F. The Board shall approve all contracts except where is has delegated that authority to others.

G. The Board shall be responsible for TBG’s compliance with the Minnesota workers’ compensation law and the related rules an regulations of the State of Minnesota.

2. Election and Termination: The Board shall consist of at lest seven (7) person. No Member may have more than one representative on the Board.

3. Director Qualification and Term. The Board shall be made up of natural persona who are officers, Directors, partners or employees of Members in TBG. No Third Party Administrator of vendor of risk management services shall serve as a Director of TBG. A Director shall hold office for a term of three years for which he/she was elected, unless his/her holding of office terminated earlier on account of death, resignation or removal. A director shall be elected by a simple majority vote of Members of TBG in attendance at the annual meeting.

4. Vacancies. Any vacancy occuring before the expiration of a Director’s term will be filled by a representative elected by a majority vote of the Board for the remainder of the term. If a Director becomes unqualified to continue as a Director because he or she is no longer an officer, director, partner or employee of a Member of TBG, the Director may continue as a Director until a replacement has been found or to the next annual meeting at the discretion of the Board. A Director may be removed at any time, with or without cause, by action of the Members at a special meeting called under the provisions of Article IV, 5 an 6.

5. Meeting of the Board: An annual meeting of the Board shall be help by the last day of May of each year in conjunction with the Annual of Members. Meetings of the Board may be help at any place that the Boards selects. A conference among Directors, by means of communication through which the Directors may simultaneously hear each other during ter conference, constitutes a Board meeting. Any two Directors may cell a Board meeting with two business days’ written notice to all other Directors. A majority of the Board must be present to constitute a quorum. Directors may appear in person or by a written appointment of a proxy appointing another Director to cast a vote on behalf of the non-attending Director. All Meetings of Members and/or the Board shall be conducted in accordance with Robert’s Rules of Order, as revised.

6. Agenda for Meetings of the Board. The Board may review such matters as may be appropriate including but not limited to the following items for the purpose of determining whether these areas of concerns are being adequately provided for: A. Service company performance. B. Loss control and safety engineering. C. Investment policies. D. Collection of delinquent debts. E. Expulsion procedures. F. Initial Member review. G. Fiscal agent performance. H. Claims handling and claims reporting. I. Marketing plan. J. Excess Policies.

7. Officers of The Board. The Directors shall elect a Chairperson to act in all matters of TBG and perform such other functions as the Board may determine; a Vice Chairperson to act in the absence of the Chairperson; a Secretary to record minutes of meetings, send necessary notices to Directors and Members, and keep such other records that may be required for the function of the Board; and a Treasurer who shall oversee the financial affairs of TBG. All officers shall serve for a term of one year.

8. Action Without Meeting: The Chairperson, Vice Chairperson, Secretary, and Treasurer shall constitute the Executive Committee of the Board and shall have full power to act on behalf of the Bard between Board meetings. In the event of a tie vote by the Executive Committee, the side on which the Chairperson votes shall prevail. Alternatively, any action required or permitted to be taken at a Board meeting may be taken by written action signed by all of the Directors.

9. Right and Obligations: A Director shall discharge the duties of the position of a Director in good faith, in a manner the Director reasonably believes to be in the best interests of TBG and with the care an ordinarily prudent person in a like position would exercise under similar circumstances. A Director is entitled to rely on information, opinions, reports, or statements prepared by the Fiscal Agent, Licensed Service Company, employees and agents of TBG, counsel, public accountants and other persons as to matters that the Director reasonably believes are within the person’s competence.

10. Indemnification: TBG shall indemnify and have a duty to defend a Director or former Director made or threatened to by made a party to proceeding by reason of his/her former or present Directorship against liability, judgments, penalties, fines, attorney’s fees, and disbursements incurred by the Director of former Director complained of in the proceeding; provided, however that the Director or former Director:

A. acted in good faith;

B. receieved no improper personal benefit;

C. had no reasonable cause to believe that his/her conduct was unlawful; and

D. had reason to believe that his/her conduct was in the nest interest of TBG.

Indemnification shall be made only to the extent the Director of former Director has not been indemnified by another organization for the expenses with respect to the same acts or omissions. In fulfiling its duty to defend the Director, TBG has the right to appoint counsel of its own choosing and direct litigation. The Director may hire his or her own attorney in addition to that assigned by TBG but the Director is solely responsible for the costs associated with hiring said counsel.

11. Compensation and Reimbursement of Directors: The Board may establish, from time to time, compensation for Board activities, attendance at Board meetings and other meetings authorized by the Board, and also reimbursement for reasonable actual expenses incurred in connection therewith.

ARTICLE VI

FISCAL AGENT

1. Appointment. The Board shall appoint a Fiscal Agent for TBG. The Fiscal Agent shall not be an owner, officer, employee or affiliate of the Licensed Service Company. Duties of the Fiscal Agent shall be:

A. To maintain and administer under the direction of the Board, an account(s) assigned by TBG.

B. To receive into the accounts all funds paid to TBG from whatever source.

C. The Fiscal Agent shall not commingle any of the assets of the self-insurers fun with assets of any individual Member of TBG.

D. To make available to the Licensed Service Company or TGB, as required, a revolving fund from which the Licensed Service Company or TBG shall pay compensation benefits and other related operating expenses which may be paid by the Licensed Service Company or TBG, including, but not necessarily limited to, WCRA insurance premiums, aggregate reinsurance premiums Special Compensation Fund assessments, commercial Self-Insurers’ Security Fund assessments, legal defences costs and Fiscal Agent and Licensed Service Company fees, as set out in their contracts for service.

E. Except to the extent not prohibited by law, to perform such additional functions as may be agreed upon by TBG and the Fiscal Agent.

ARTICLE VII

SERVICE COMPANY

1. Appointment. The Board shall appoint a service company for TBG who is licensed in accordance with Minn. Stat. § 60A.23, Subd. 8 that must employ or have under contract a claims adjuster with at least three years of Minnesota specific workers’ compensation claim handling experience and licensed under Minn. Stat § 72B. The Board may assign, either in whole or in part, any or all of the duties of the Licensed Service Company to TBG employees or agents, to the extent allowed by Minn. Stat § § 60A and 79A.

2. Duties. Duties of the service company shall be:

A. To receive and investigate all claims for compensation benefits, make initial determination of compensability and set loss reserves;

B. To work with TBG staff to pay claims in accordance with Minn. Stat. § 176 or other related expenses of TBG from the revolving fund provided by the Fiscal Agent;

C. To maintain books and records in the office of the service company in the State of Minnesota and file, on behalf of TBG, reports required by the laws and regulations of the State of Minnesota, Such books and records shall be available for inspection by the Board upon reasonable notice to the service company;

D. To comply with all laws and regulations of the State of Minnesota, including provisions of Minnesota Statue Chapter 72A, as they relate to the licensing and duties of service companies;

E. All program such additional function as may be agreed upon by TBG and the licensed service company shall be the sole property of TBG; and

F. To perform such additional functions as may be agreed upon by TBG and the licensed service company, where not prohibited by law.

ARTICLE VIII

AMENDMENT OF BYLAWS

Amendments to the bylaws, if necessary, shall be made by a vote of a simple majority of the Board at a meeting held in accordance with the provisions of Article V Subp.

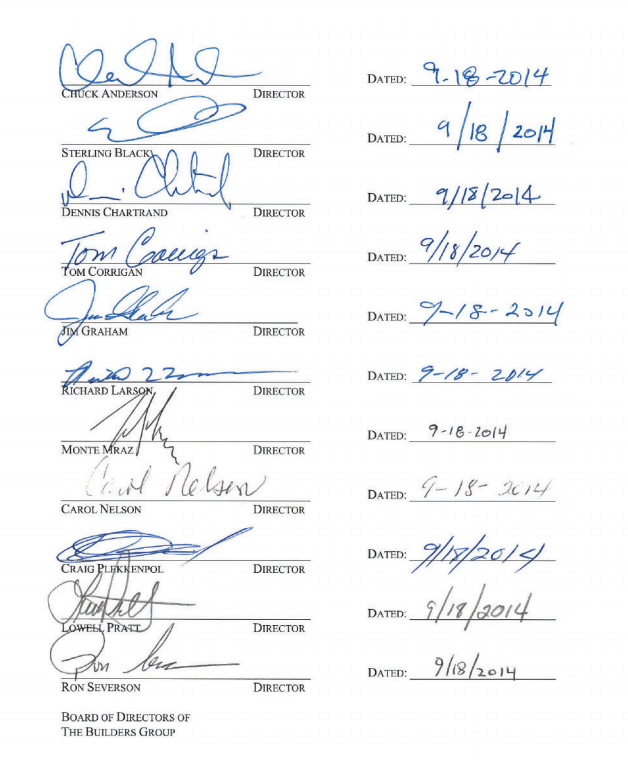

5. IN WITNESS WHEREOF, the undersigned have hereunto affixed their signatures.

First Amendment to

The Builders Group Commercial Self Insurance

Group Amended and Restated Bylaws

Dated August 15, 2014

WHEREAS, on August 15, 2014, pursuant to Minnesota Statutes § §79A.19 et seq.; 176.181, subd. 2 and Minnesota Rules Revised, Chapter 2780, the Board of Directors of The Builders Group adopted The Builders Group Commercial Self Insurance Group Amended and Restated Bylaws (the “TBG Bylaws”); and

WHEREAS, Article VIII of the TBG Bylaws permits the amendment to said bylaws by a vote of a simple majority of the Board of Directors;

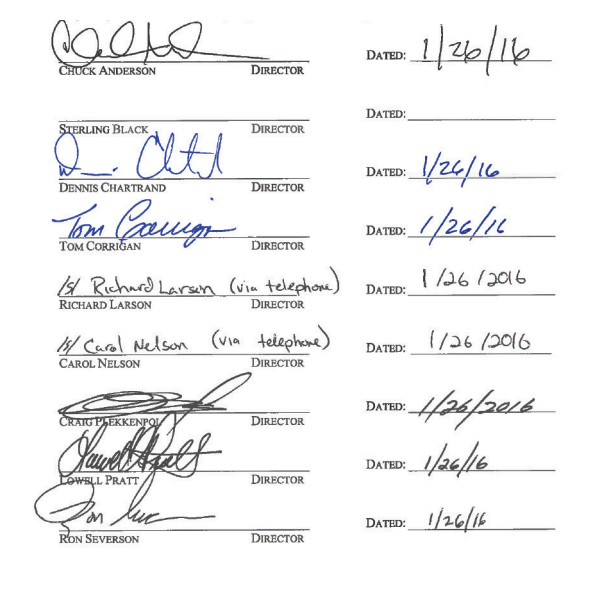

WHEREAS, on January, 26, 2016 the following members of the board of directors participated in a special meeting of the Board of Directors, called specifically to address the amendment of the TBG Bylaws; and

RESOLVED, that the following language shall be substituted, in its entirety, for Article II(C):

C. The language of the current TBG Plan of Operation is hereby incorporated into these Bylaws by reference.

RESOLVED FURTHER, that the following language shall be substituted, in its entirety, for Article V(3):

3. Director Qualification and Term The Board shall be made up of natural persons who are owners or employees of a Member of TBG. The Member must have been Fund at least five (5) years, be in good standing, and have ongoing payroll and sales. No third Party Administrator of vendor of risk management services shall serve as a Director of TBG. A Director shall hold office for a term of three (3) years for which he;she was elected, unless his/her holding of office terminates earlier on account of death, resignation, disqualification or removal. A director shall be elected by a simple majority vote of the Members of TBG in attendance at the annual meeting.

RESOLVED FURTHER, that the following language shall be substituted, in its entirety, for Article V(4):

4. Vacancies. Any vacancy occurring before the expiration of a Director’s term will be filled by representative elected by majority vote of the Board for the remainder of the term. If a Director becomes unqualified to continue as a Director, the Director may continue as a Director until a replacemtn has been found or until the next annual meeting at the discretion of the Board. A Director may be removed at any time, with or without cause, by action of the Members at a special meeting called under the provisions of Article IV (5) and (6).

IN WITNESS WHEREOF, the undersigned have hereunto affixed their signture, constituting a simple majority of directors participating in the aforementuined special meeting of the Board of Directors.